To help electric vehicles reach ubiquity, governments and EV charging companies must ensure the availability of fast-charging infrastructure doesn’t become a bottleneck for growth.

A McKinsey research

In the past decade, electric vehicles (EVs) have gone from a rare sight on even the busiest road

to an increasingly common, affordable option. In 2020, EV sales set new records that surpassed expectations, particularly in countries with an eager customer base and government policies supporting the transition to EVs. Much of this leadership has come from Europe, where EV adoption has surged; by July 2021, for example, two-thirds of Oslo’s residents owned an EV.1 According to McKinsey analysis, 45 percent of customers are considering buying an EV.

In addition to consumer enthusiasm and government regulations and incentives, the number of industry players committed to phasing out internal combustion engine (ICE) vehicles continues to grow. Such commitments are still in early stages, but by 2050 the bans OEMs have announced to date will account for more than half of today’s passenger vehicle sales, and the EU is aiming for an ICE ban by 2035, likely pulling other countries’ commitments forward as well.2 All signs point to continued growth in the EV market, with Europe leading the charge: McKinsey projections suggest EVs will make up 75 percent of European new car sales by 2030.

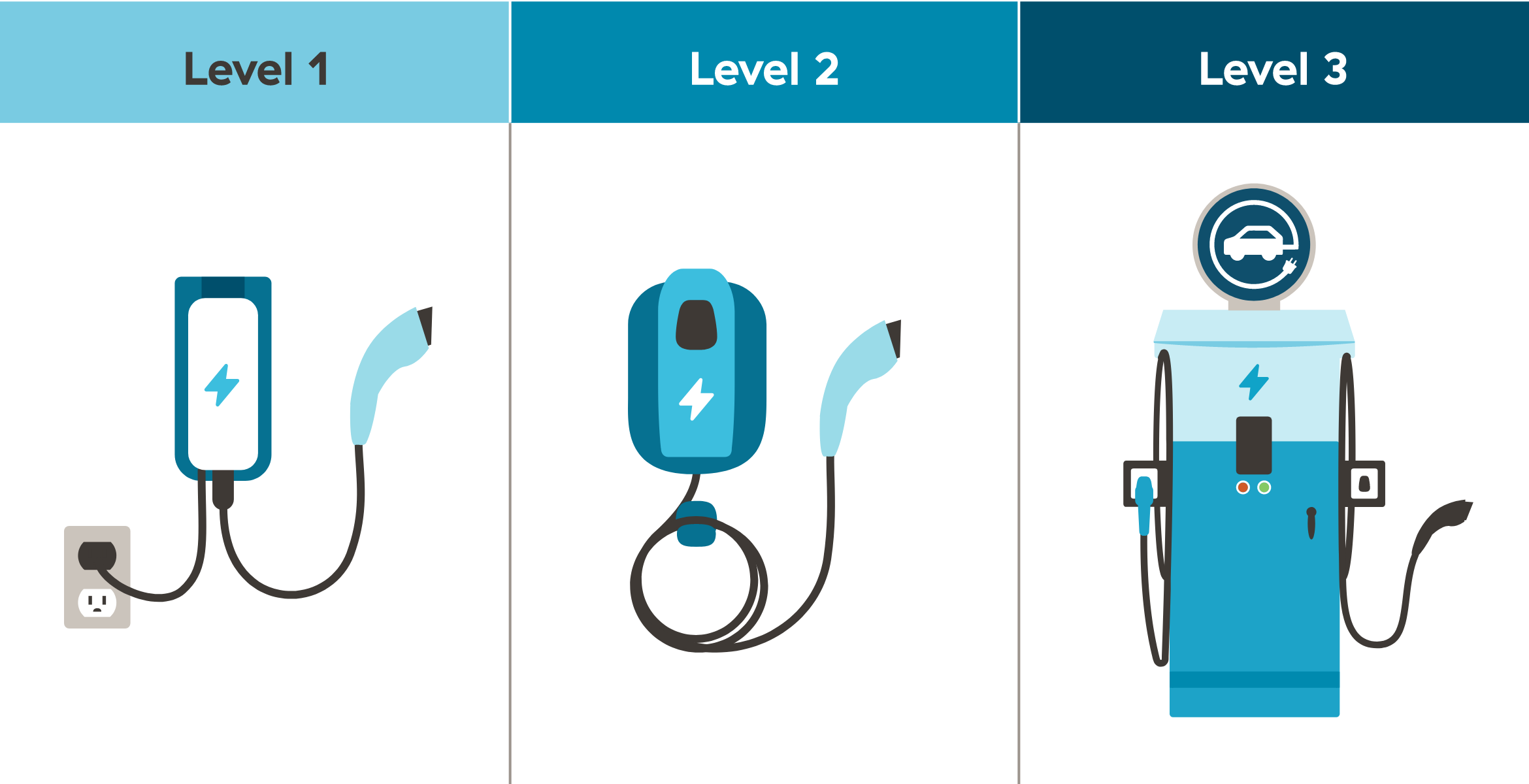

All this growth means we need more places to charge EVs—now. Everywhere from homes and workplaces to retail sites, fleet depots, and on-the- go charging sites, the race is on to build enough public fast-charging stations to meet demand, remove perceived inconvenience for those still hesitating to transition to EVs, and ultimately

help meet CO2 emission reduction targets. Some actions governments and companies can take include offering incentives to build private chargers, subsidizing public charging, and investing in production capacity and a skilled workforce.

EV charging infrastructure could become a bottleneck for growth

As EVs have become increasingly affordable, one of the primary barriers for consumers is no longer

cost but charging convenience. In McKinsey’s 2020 ACES Consumer Survey, potential EV drivers put the lack of charging infrastructure at the top of the list of barriers to expanded EV adoption. Today, most EV charging is done at home, but the availability and convenience of publicly accessible chargers will be crucial for complete electrification of the vehicle fleet.

Although momentum in charging infrastructure has increased—Europe’s public charger count increased fourfold between 2015 and 20203—four risks could turn charging into a bottleneck:

— Regulations. In many geographies, securing permits to build chargers, construct sites, and connect to the electric grid can require months, or even years, of planning.

— Grid. Especially in areas with high charging demand, the electrical grid needs to be upgraded to expand power capacity—which include expensive and time-consuming updates.

— Resources. Several resources are in short supply, including skilled technicians, production capacity for fast-charging hardware, and enough green energy to make EVs fully environmentally friendly.

— Cost. EV charging infrastructure is not cheap; in the European Union, a typical 350-kilowatt (kW) charger can cost $150,000, including hardware, installation, and planning.

Actions to mitigate the threat of EV charging infrastructure shortages Solution providers and owners and operators

of charging networks play a key role in scaling EV-charging infrastructure, yet the broader ecosystem can help address a number of challenges. This includes, among others, OEMs, real estate providers, utilities and grid operators, and infrastructure funds.

With this in mind, governments and companies can take several actions to address the leading risks facing EV charging infrastructure.

Governments

Offer more incentives and mandates for building private chargers. Many countries are finding success with establishing incentive schemes for consumers, such as refunds for installing a wall box. They are also increasingly introducing requirements and subsidies for apartment buildings and other multiunit dwellings to offer chargers, as well as

for companies to install chargers at workplaces— indeed, chargers will eventually become a standard part of building design.4 These inducements should be structured to direct money toward the biggest bottlenecks for EV growth in a given community—for example, earmarking more incentive funding for apartment buildings in dense areas with limited parking.

Subsidize public charging in necessary locations.

Subsidies—for capital expenditure on chargers, installation, and power distribution, as well as ongoing costs for operation—can help draw EV charging to areas where it is most needed. Such subsidies can make it economically viable to build chargers in areas where long-term profitability

can outweigh short-term costs. Some governments, such as New York City’s, are funding installation costs to build chargers in high-demand areas; others, such as Germany’s, are sponsoring an entire network to be operated by private companies. A successful effort will require modeling of demand, grid capacity, and other factors to determine priorities for investment.

Work with utilities to build out the electric grid.

Electric grids will need to expand capacity to ensure they can cover the demand that will be created by

a future of EV-covered roads. Governments might direct funding to grid operators earmarked to build capacity starting in areas with high local charging demand. They can also consider developing a new grid fee system that accounts for peak demand

charging need, protects the grid from overutilization, and keeps charging economically viable at ultrafast charging locations.

Link incentives and subsidies to use of green energy. Achieving net-zero road emissions requires ensuring EV chargers are distributing 100 percent green energy. Where possible, governments can advance multiple sustainability agendas by requiring recipients of incentives and subsidies to commit to using green energy.

Simplify and standardize permitting. In extreme scenarios, securing a permit for a charger site, including installation and grid updates, can take

two years. Streamlining permitting to accelerate throughput will take concerted action at a number of levels of government and in most geographies.

EV charging companies

Invest in production capacity and a skilled workforce.

Now is the time for EV charging companies to scale, build out factories and supply chains in relevant regions to match demand, and develop a growth- minded talent strategy. These resources will form the foundation for successful rollouts of chargers in the coming years.

Partner to finance public chargers. Infrastructure funds and other potential investment partners offer alternative funding sources to help build, install, and operate public chargers. Beyond raising money, such partners may also be interested in other methods

of funding capital, such as purchasing charging infrastructure assets in exchange for stable returns.

Use data and analytics for network planning.

Sophisticated, data-driven planning will be required to identify the best sites for a successful, in-demand charging network. For example, geospatial analytics allow planners to optimize locations based on traffic flows, local grid status, and other relevant factors.

Reduce “range anxiety” of potential EV drivers. Perception of potential issues with switching from ICE to EV needs to be proactively addressed. Ongoing consumer education efforts around helpful tools (such as integrated trip planning or charger reservations) and additional advantages of EVs (such as integration with a home solar system)

is required.

In 2020, the EV rubber hit the road. Over the next decade, EVs will help redefine the

intersection of mobility and infrastructure—and, in doing so, will, contribute significantly to

achieving net-zero emissions targets.

By: Stefan Heldmann is an associate partner in McKinsey’s Frankfurt office; Florian Nägele is a partner in the Zurich office; and Felix Richter is an associate partner in the Berlin office.